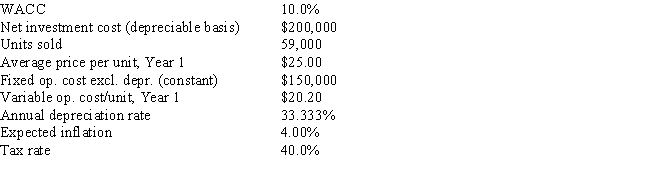

Poulsen Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an inflation adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made versus if it is not made? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Monthly Deposits

Regular monetary contributions made into a savings or investment account over a monthly interval.

Personalized Presidency

An approach to the presidency where the occupant relies on their personal image and direct relationship with the public, often through media, rather than through traditional party structures.

Political Figures

Individuals who hold or seek public office and are involved in the governance of their country or region, often shaping policy and public opinion.

Character Traits

Attributes or features that make up and distinguish an individual's personality.

Q3: Maxwell Feed & Seed is considering a

Q4: Which of the following statements is CORRECT?<br>A)

Q15: The primary advantage to using accelerated rather

Q21: Bell Brothers has $3,000,000 in sales.Fixed costs

Q21: Stocks A and B both have an

Q46: In Japan,90-day securities have a 4% annualized

Q47: If one U.S.dollar buys 0.61 euro,how many

Q47: Swim Suits Unlimited is in a highly

Q48: The Francis Company is expected to pay

Q57: Any change in its beta is likely