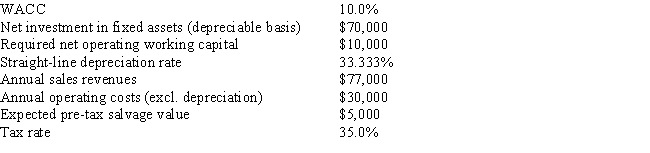

Thomson Media is considering some new equipment whose data are shown below.The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years,but it would have a positive pre-tax salvage value at the end of Year 3,when the project would be closed down.Also,additional net operating working capital would be required,but it would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Merchandising Companies

Companies that purchase goods in a finished condition and resell them at a profit without further processing.

Operating Cycles

Operating cycles refer to the average period of time it takes for a business to convert its inventory to sales revenue and then to cash.

Profit Margins

A financial metric measuring the amount of net income generated as a percentage of revenue, reflecting the profitability of a business.

Perpetual Inventory System

A method of maintaining inventory records where updates are made continuously after each purchase or sale.

Q6: The use of financial leverage by the

Q16: As a consultant to First Responder Inc.

Q19: Scanlon Inc.'s CFO hired you as a

Q24: Affleck Inc.'s business is booming,and it needs

Q26: Amram Inc.can issue a 20-year bond with

Q35: Estimating project cash flows is generally the

Q48: Which of the following statements is CORRECT?<br>A)

Q60: If a firm's marginal tax rate is

Q68: The cost of debt is equal to

Q72: Weiss Inc.arranged a $9,000,000 revolving credit agreement