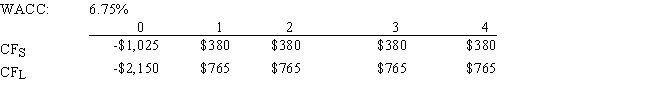

A firm is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise the firm on the best procedure.If the wrong decision criterion is used,how much potential value would the firm lose?

Definitions:

Schizophrenia

A mental disorder characterized by disruptions in thought processes, perceptions, emotional responsiveness, and social interactions.

Placebo Effect

A phenomenon in which a person experiences a perceived improvement in condition due to personal expectations, rather than the treatment itself having any therapeutic effect.

Antidepressants

Medications prescribed to alleviate symptoms of depression by adjusting the balance of neurotransmitters in the brain.

Autism

A neurodevelopmental disorder characterized by challenges with social interaction, communication, and by restrictive and repetitive behaviors.

Q5: You have funds that you want to

Q13: Assume that interest rates on 20-year Treasury

Q25: Managers should under no conditions take actions

Q32: Agarwal Technologies was founded 10 years ago.It

Q34: Currently,Powell Products has a beta of 1.0,and

Q35: If a firm's capital intensity ratio (A

Q69: Which of the following should be considered

Q88: Which of the following statements is CORRECT?<br>A)

Q95: A firm should never accept a project

Q113: Mikkelson Corporation's stock had a required return