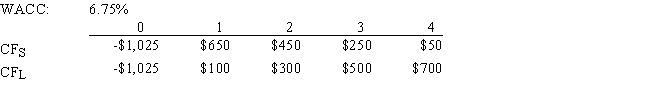

Moerdyk & Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,i.e. ,no conflict will exist.

Definitions:

Just-In-Time (JIT) System

A supply chain management strategy that reduces inventory costs by delivering raw materials and components just as they are needed in the production process.

Sudden Increase In Demand

A rapid and unexpected rise in the desire or need for a specific product or service, which can impact market dynamics.

Long-Term Relationships

Enduring associations between companies and their stakeholders, such as customers or suppliers, typically characterized by trust, loyalty, and mutual benefit over time.

Fixed-Position Layout

An operational strategy where the product remains stationary, and workers, materials, and equipment are moved as needed.

Q9: The NPV method's assumption that cash inflows

Q21: If the pure expectations theory is correct

Q24: A conflict will exist between the NPV

Q24: When working with the CAPM,which of the

Q30: Which of the following statements is CORRECT?<br>A)

Q52: Roenfeld Corp believes the following probability distribution

Q79: Noe Drilling Inc.is considering Projects S and

Q80: Ingram Office Supplies,Inc. ,buys on terms of

Q81: Assume a project has normal cash flows.All

Q102: A stock's beta is more relevant as