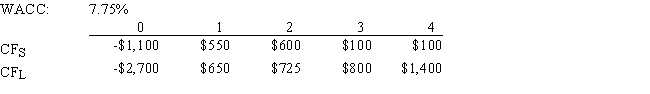

Tesar Chemicals is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e. ,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

Definitions:

Second Continental Congress

A convention of delegates from the Thirteen Colonies that started meeting in the spring of 1775, soon after the beginning of the American Revolutionary War.

Own Constitutions

Refers to the legal documents that define the principles according to which an entity, such as a state or organization, is governed.

State Constitutions

The fundamental laws and principles that establish the framework of governance within each of the United States.

Executive Branch

Part of the U.S. government responsible for enforcing laws, headed by the President and including cabinet departments and agencies.

Q2: Assume that to cool off the economy

Q2: Rowell Company spent $3 million two years

Q11: Dothan Inc.'s stock has a 25% chance

Q21: A share of common stock just paid

Q44: Stock A's beta is 1.5 and Stock

Q49: Rivoli Inc.hired you as a consultant to

Q64: For a stock to be in equilibrium,that

Q81: Carter's preferred stock pays a dividend of

Q110: Nagel Equipment has a beta of 0.88

Q118: Stock A has a beta of 0.7,whereas