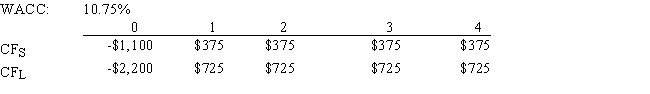

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

English Football

Describes the game of soccer as played in England, featuring a structure from amateur and youth clubs up to professional leagues.

Prejudice

Prejudice is a preconceived opinion or bias against an individual or group without sufficient knowledge, thought, or reason.

Stereotyping

Assigning generalized attributes to individuals based on their membership in a particular group, leading to oversimplified opinions.

Morally Wrong

Actions or behaviors that are in violation of ethical or moral principles.

Q7: Suppose the rate of return on a

Q16: Assume that a noncallable 10-year T-bond has

Q17: For a zero-growth firm,it is possible to

Q43: Which of the following events is likely

Q55: Malko Enterprises' bonds currently sell for $1,020.They

Q57: Any change in its beta is likely

Q66: Firm A is very aggressive in its

Q67: Suppose the real risk-free rate is 2.50%

Q74: CCC Corp has a beta of 1.5

Q74: A 25-year,$1,000 par value bond has an