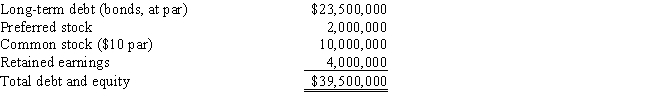

In order to accurately assess the capital structure of a firm,it is necessary to convert its balance sheet figures from historical book values to market values.KJM Corporation's balance sheet (book values) as of today is as follows:  The bonds have a 8.3% coupon rate,payable semiannually,and a par value of $1,000.They mature exactly 10 years from today.The yield to maturity is 11%,so the bonds now sell below par.What is the current market value of the firm's debt?

The bonds have a 8.3% coupon rate,payable semiannually,and a par value of $1,000.They mature exactly 10 years from today.The yield to maturity is 11%,so the bonds now sell below par.What is the current market value of the firm's debt?

Definitions:

Q7: Which of the following statements is CORRECT?<br>A)

Q12: Two metrics that are used to measure

Q15: Small businesses make less use of DCF

Q26: If the IRR of normal Project X

Q32: Agarwal Technologies was founded 10 years ago.It

Q33: A Treasury bond has an 8% annual

Q39: An individual stock's diversifiable risk,which is measured

Q55: Assume that Congress recently passed a provision

Q83: Last year Kruse Corp had $410,000 of

Q137: A highly risk-averse investor is considering adding