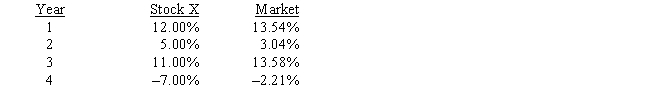

Stock X and the "market" have had the following rates of returns over the past four years. 58% of your portfolio is invested in Stock X and the remaining 42% is invested in Stock Y.The risk-free rate is 7.68% and the market risk premium is also 7.68%.You estimate that 15.97% is the required rate of return on your portfolio.What is the beta of Stock Y?

Definitions:

Patterned Responses

Behavioral reactions that follow a predictable or habitual pattern, often developed in response to specific stimuli or situations.

Clusters

Groups or collections of similar items, events, or characteristics closely positioned or occurring together.

Behavior

The actions or reactions of an individual or group in response to external or internal stimuli.

Conflict Avoidance

A strategy or approach where individuals preemptively avoid situations or discussions that are likely to lead to disagreements or disputes.

Q1: Keys Financial has done extremely well in

Q1: A firm's ability to obtain cash for

Q11: What is the basic assumption of agency

Q15: Suppose a foreign investor who holds tax-exempt

Q16: Discuss the environmental factors that impact on

Q30: As a firm's sales grow,its current assets

Q42: Data on Wentz Inc.for last year are

Q45: You work for the CEO of a

Q49: Miller and Modigliani's dividend irrelevance theory says

Q53: Although short-term interest rates have historically averaged