Exhibit 8A.1

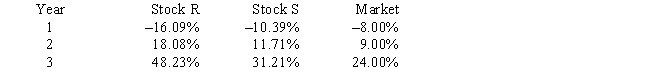

You have been asked to use a CAPM analysis to choose between Stocks R and S,with your choice being the one whose expected rate of return exceeds its required return by the widest margin.The risk-free rate is 5.00%,and the required return on an average stock (or the "market") is 9.00%.Your security analyst tells you that Stock S's expected rate of return is equal to 12.00%,while Stock R's expected rate of return is equal to 14.00%.The CAPM is assumed to be a valid method for selecting stocks,but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock.The following past rates of return are to be used to calculate the two stocks' beta coefficients,which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed,and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Calculate both stocks' betas.What is the difference between the betas? That is,what is the value of betaR − betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 − Y1) divided by (X2 − X1) may aid you. )

Definitions:

Return on Assets

A ratio indicating how efficiently a company is using its assets to generate profit, calculated as net income divided by total assets.

Earnings Per Share

A metric that divides a company's profit available to its common stockholders by the average outstanding shares.

Debt-to-Equity

A metric illustrating the comparative levels of a company's debt and shareholder equity utilized in asset financing.

Long-Term Bonds Payable

Bonds that are due for repayment after a period exceeding one year from the balance sheet date.

Q7: The physical capital maintenance concept of income

Q10: The SFAS No 157 FASB ASC 820)fair

Q11: Who was the author of Accounting Research

Q16: Under the acquisition method for a business

Q19: "Trading on the equity" financial leverage)is likely

Q19: Financial risk refers to the extra risk

Q26: If a firm pays out all of

Q28: A deferred credit meets the definition of

Q31: Which of the following statements is CORRECT?<br>A)

Q31: Calculating a currency cross rate involves determining