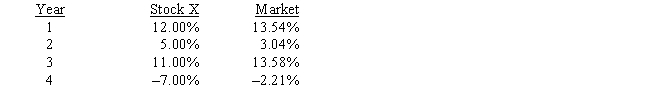

Stock X and the "market" have had the following rates of returns over the past four years. 58% of your portfolio is invested in Stock X and the remaining 42% is invested in Stock Y.The risk-free rate is 7.68% and the market risk premium is also 7.68%.You estimate that 15.97% is the required rate of return on your portfolio.What is the beta of Stock Y?

Definitions:

Difference-In-Differences

A statistical technique used in econometrics and quantitative research to determine the effect of a specific intervention or treatment by comparing the before-and-after differences in outcomes between a control group and a treatment group.

Causal Effects

The relationship or impact that one variable has in directly changing the value or outcome of another variable.

Policy

A course or principle of action adopted or proposed by an organization or individual.

Causation

The relationship between cause and effect where one event directly results in another.

Q3: Which of the following bodies has the

Q9: Footnotes to a company's financial statements are

Q9: A 4-year,zero coupon Treasury bond sells at

Q13: If two firms have the same expected

Q15: How are operating segments defined by SFAS

Q20: The accounts receivable turnover and inventory turnover

Q24: The firm's ability to convert an asset

Q37: Theoretically,a bond payable should be reported at

Q48: Suppose 90-day investments in Britain have a

Q94: If one U.S.dollar sells for 0.40 British