Exhibit 8A.1

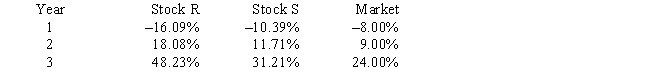

You have been asked to use a CAPM analysis to choose between Stocks R and S,with your choice being the one whose expected rate of return exceeds its required return by the widest margin.The risk-free rate is 5.00%,and the required return on an average stock (or the "market") is 9.00%.Your security analyst tells you that Stock S's expected rate of return is equal to 12.00%,while Stock R's expected rate of return is equal to 14.00%.The CAPM is assumed to be a valid method for selecting stocks,but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock.The following past rates of return are to be used to calculate the two stocks' beta coefficients,which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed,and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Calculate both stocks' betas.What is the difference between the betas? That is,what is the value of betaR − betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 − Y1) divided by (X2 − X1) may aid you. )

Definitions:

Prepaid Interest

Interest starts accruing (building) at the beginning of each month and continues throughout the month; prepaid interest at the closing is the amount of mortgage interest due to cover the time from the closing date to when the first mortgage payment is due.

Down Payment

The upfront money applied to a purchase that is made using a loan (credit).

Mortgage

A loan specifically used to purchase real estate, where the property itself serves as collateral until the loan is repaid.

Closing Costs

Costs that are paid at closing that include origination fees, attorney fees, points, prepaid interest, transfer tax, and title insurance.

Q5: How did SFAS No.116,now FASB ASC 605-10-15-3,change

Q9: Overstating sales returns or warranty costs in

Q11: To determine the amount of additional funds

Q14: At the beginning of the year,you purchased

Q15: The funded status of a defined benefit

Q16: Discuss the difference between defined benefit and

Q28: Under Statement of Financial Accounting Concepts No.8,which

Q37: Based on the information below,what is the

Q37: A foreign currency will,on average,depreciate against the

Q50: If a dollar will buy fewer units