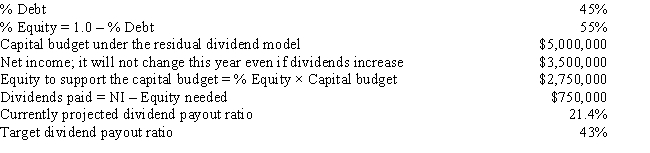

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio? Do not round intermediate calculations.

Definitions:

Tectonic Plates

Large pieces of the Earth's crust that move, float, and sometimes fracture and whose interaction causes continental drift, earthquakes, volcanoes, mountains, and oceanic trenches.

Ejecta

Material that is expelled or thrown out, especially as a result of volcanic eruption, meteorite impact, or other explosive events.

Sedimentary

Pertaining to rocks formed by the accumulation or deposition of mineral or organic particles at the Earth's surface, followed by compaction.

Sandstone

A sedimentary rock composed mainly of sand-sized minerals or rock grains.

Q6: The efficient market hypothesis holds that that

Q20: Which of the following is NOT a

Q21: Under Statement of Financial Accounting Concepts No.8,confirmatory

Q61: Classified stock differentiates various classes of common

Q64: When deciding whether or not to take

Q69: Temple Corp.is considering a new project whose

Q77: A firm's capital structure does not affect

Q79: Founders' shares,a type of classified stock owned

Q91: Market risk refers to the tendency of

Q107: Diversification will normally reduce the riskiness of