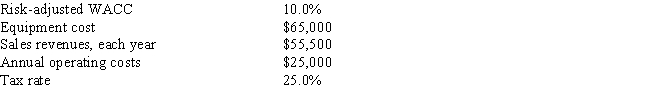

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.The equipment would have a zero salvage value at the end of the project's life.No change in net operating working capital (NOWC) would be required.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Header

Text or graphic printed at the top of every page in a document or appearing at the beginning of a section online.

Row Height

The vertical dimension of a row in a table or spreadsheet, which can be adjusted to accommodate the content within.

Average Function

A mathematical operation in spreadsheet programs that calculates the mean value of a selected range of cells.

Right Parenthesis

The closing bracket in a pair of parentheses, used to enclose text or numbers, symbolized as ")".

Q2: Warnock Inc.is considering a project that has

Q14: The two cardinal rules that financial analysts

Q25: Modigliani and Miller's second article,which assumed the

Q27: Which of the following statements is CORRECT?<br>A)

Q29: Kamath-Meier Corporation's CFO uses this equation,which was

Q33: Walter Industries is a family owned concern.It

Q66: Madura Inc.wants to increase its free cash

Q75: Which of the following statements is CORRECT?<br>A)

Q85: Assume that you are on the financial

Q92: The prices of high-coupon bonds tend to