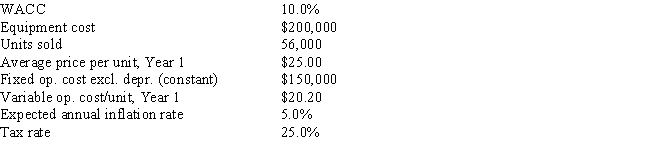

Desai Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.At the end of the project's life,the equipment would have no salvage value.No change in net operating working capital (NOWC) would be required for the project.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.What is the project's expected NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Intrinsic Value

The actual, fundamental value of an asset, based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors.

Warrants

Securities that give the holder the right, but not the obligation, to buy a company's stock at a specific price before a certain date.

Q2: Warnock Inc.is considering a project that has

Q12: Which of the following statements is CORRECT?<br>A)

Q14: Stocks X and Y have the following

Q22: Which of the following statements is CORRECT?

Q26: You have been hired by a new

Q36: A basic rule in capital budgeting is

Q38: Clayton Industries is planning its operations for

Q64: Junk bonds are high-risk,high-yield debt instruments.They are

Q71: A currency trader observes the following quotes

Q81: Stocks A,B,and C all have an expected