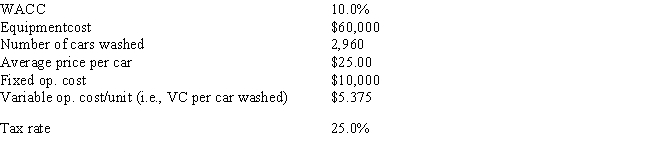

Florida Car Wash is considering a new project whose data are shown below.The equipment to be used has a 3-year tax life.Under the new tax law,the equipment is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.At the end of the project's 3-year life,it would have zero salvage value.No change in net operating working capital (NOWC) would be required for the project.Revenues and operating costs will be constant over the project's life,and this is just one of the firm's many projects,so any losses on it can be used to offset profits in other units.If the number of cars washed declined by 40% from the expected level,by how much would the project's NPV change? (Hint: Note that cash flows are constant at the Year 1 level,whatever that level is. ) Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Double Helix

The structure formed by double-stranded molecules of nucleic acids such as DNA, characterized by its spiraling ladder shape.

Carrier

A person who carries and transmits characteristics but does not exhibit them.

Transmits Characteristics

The process by which genetic features and traits are passed down from parents to their offspring.

Double Helix

The structure of DNA, characterized by two strands coiled around each other, forming a shape similar to a twisted ladder, responsible for genetic inheritance.

Q9: Gupta Corporation is undergoing a restructuring,and its

Q11: Gator Fabrics Inc.currently has zero debt .It

Q19: The calculated cost of trade credit for

Q34: The lower the firm's tax rate,the lower

Q42: Because political risk is seldom negotiable,it cannot

Q42: Which of the following statements is CORRECT?<br>A)

Q54: A firm that bases its capital budgeting

Q61: Both the regular and the modified IRR

Q70: Monroe Inc.is an all-equity firm with 500,000

Q110: Which of the following statements is CORRECT?<br>A)