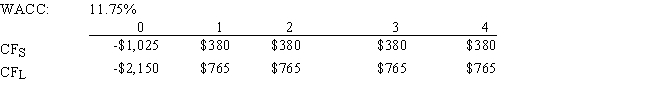

A firm is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise the firm on the best procedure.If the wrong decision criterion is used,how much potential value would the firm lose?

Definitions:

Sixteenth Century

Refers to the period from 1501 to 1600, marking significant global exploration and cultural exchanges between Europe and other parts of the world.

European Countries

Nations located on the continent of Europe, each with its distinct geography, culture, and government.

European Slave Traders

Individuals or entities from Europe who engaged in the capture, transportation, and sale of African people into slavery from the 16th to 19th centuries.

African Slaves

People from Africa who were forcibly taken from their homeland, trafficked to other parts of the world, and subjected to slavery by various powers from the 16th to 19th centuries.

Q18: When developing forecasted financial statements there are

Q26: A firm's profit margin is 5%,its debt

Q30: Foley Systems is considering a new project

Q58: Based on the corporate valuation model,the total

Q59: Net working capital is defined as current

Q64: One of the four most fundamental factors

Q64: Inflation,recession,and high interest rates are economic events

Q65: Which of the following statements is CORRECT?<br>A)

Q69: Temple Corp.is considering a new project whose

Q84: Stocks A and B both have an