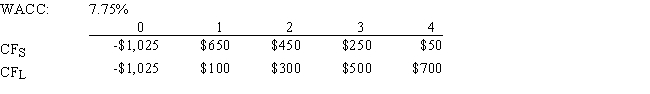

Moerdyk & Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,i.e. ,no conflict will exist.

Definitions:

Cash Subsidy

A form of financial aid or support from the government to individuals or organizations, often intended to encourage certain activities or reduce the cost burden.

Low Income Families

Households earning significantly less than the average income level, often facing financial challenges in meeting basic needs such as food, shelter, and healthcare.

Indifference Curves

Graphical representations in microeconomics illustrating combinations of various goods between which a consumer is indifferent.

Consumption Bundle

A specific collection of goods and services consumed by an individual or household.

Q6: If the IRR of normal Project X

Q33: A 25-year,$1,000 par value bond has an

Q37: If a firm's stockholders are given the

Q59: Assuming that their NPVs based on the

Q62: Which of the following statements is CORRECT?<br>A)

Q64: According to Modigliani and Miller (MM),in a

Q70: Which of the following statements is CORRECT?<br>A)

Q70: If the Treasury yield curve is downward

Q82: Which of the following statements is CORRECT?<br>A)

Q85: The trade-off theory states that capital structure