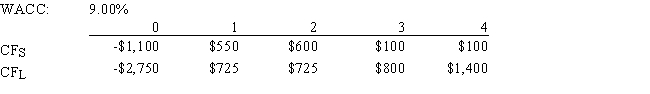

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e. ,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Traits

Distinguishing qualities or characteristics typically belonging to a person, can be genetic or acquired through life experiences.

Concept Of Self

Refers to the way an individual thinks about, evaluates, or perceives themselves.

Identity

Identity refers to the qualities, beliefs, personality, looks, and expressions that make a person or group distinct from others.

Foreclosure

The legal process by which a lender takes control of a property, evicts the homeowner, and sells the home after the homeowner fails to make full principal and interest payments on a mortgage.

Q7: Last year Jain Technologies had $250 million

Q9: One of the four most fundamental factors

Q14: Stocks X and Y have the following

Q25: Small businesses make less use of DCF

Q27: Whited Products recently completed a 4-for-1 stock

Q45: Which of the following statements is CORRECT?<br>A)

Q55: A stock is expected to pay a

Q71: In a portfolio of three randomly selected

Q84: Stocks A and B both have an

Q90: The phenomenon called "multiple internal rates of