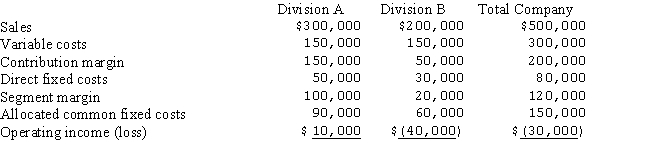

Consider the Marshall Company's segment analysis:  Common costs are allocated based on sales dollars.If Marshall eliminates Segment B,what is the impact on the operating loss of the company?

Common costs are allocated based on sales dollars.If Marshall eliminates Segment B,what is the impact on the operating loss of the company?

Definitions:

Treasurer

An officer in an organization responsible for managing the institution's treasury, including financial planning, risk management, and investment activities.

Controller

A high-level executive responsible for overseeing the accounting operations of a company, including financial reporting and budgeting.

S-Type Corporations

A special designation that allows profits to be passed directly to shareholders without being subjected to corporate income taxes, but with limitations on number and type of shareholders.

Double Taxation

A situation in which the same income is taxed twice; this commonly applies to corporate income taxed at both the company level and again when distributed to shareholders as dividends.

Q11: The goal of profit maximisation ignores the

Q12: Producing goods evenly throughout the year despite

Q19: Rewarding executives for increasing quarterly earnings will

Q27: Capital markets are markets for short-term debt

Q35: Which of the following should be considered

Q37: Claudia's Cupcakes has sales of $3 450

Q52: Tennenholtz Company's break-even graph is depicted below.The

Q52: The practice of assigning costs evenly to

Q83: Which of the following statements is false?<br>A)A

Q84: Which of the following types of business