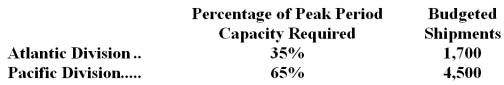

Derico Corporation has two operating divisions-an Atlantic Division and a Pacific Division.The company's Logistics Department services both divisions.The variable costs of the Logistics Department are budgeted at $42 per shipment.The Logistics Department's fixed costs are budgeted at $365,800 for the year.The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year,actual Logistics Department variable costs totaled $388,800 and fixed costs totaled $378,080.The Atlantic Division had a total of 4,700 shipments and the Pacific Division had a total of 4,300 shipments for the year.For performance evaluation purposes,how much actual Logistics Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year,actual Logistics Department variable costs totaled $388,800 and fixed costs totaled $378,080.The Atlantic Division had a total of 4,700 shipments and the Pacific Division had a total of 4,300 shipments for the year.For performance evaluation purposes,how much actual Logistics Department cost should NOT be charged to the operating divisions at the end of the year?

Definitions:

Q2: Using the least-squares regression method,the estimate of

Q7: What is the net advantage or disadvantage

Q7: A company needs an increase in working

Q10: The net present value of the project

Q15: The fixed manufacturing overhead budget variance is:<br>A)$1,000

Q15: A company anticipates a depreciation deduction of

Q31: The internal rate of return of the

Q36: Closter Corporation makes three products that use

Q77: Vanikoro Corporation currently has two divisions which

Q79: Which of the following is not correct?<br>A)If