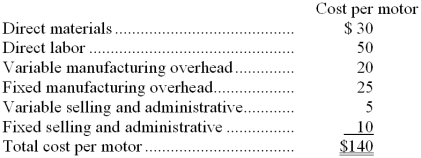

The Commando Motorcycle Company has decided to become decentralized and split its operations into two divisions, Motor and Assembly. Both divisions will be treated as investment centers. The Motor Division is currently operating at its capacity of 30,000 motors per year. Motor's costs at this level of production are as follows:  Motor sells 10,000 of its motors to a snowmobile manufacturer and transfers the remaining 20,000 motors to the Assembly Division. The two divisions are currently in a debate over an appropriate transfer price to charge for the 20,000 motors. Motor currently charges the snowmobile manufacturer $200 per motor. The final selling price of the motorcycles that Commando produces is $7,200 per cycle. This selling price will not change regardless of the transfer price charged between the two divisions. Motor has no market for the 20,000 motors if they are not transferred to Assembly. Variable selling and administrative costs are incurred on both internal and external sales.

Motor sells 10,000 of its motors to a snowmobile manufacturer and transfers the remaining 20,000 motors to the Assembly Division. The two divisions are currently in a debate over an appropriate transfer price to charge for the 20,000 motors. Motor currently charges the snowmobile manufacturer $200 per motor. The final selling price of the motorcycles that Commando produces is $7,200 per cycle. This selling price will not change regardless of the transfer price charged between the two divisions. Motor has no market for the 20,000 motors if they are not transferred to Assembly. Variable selling and administrative costs are incurred on both internal and external sales.

-Fistman Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Products Division has asked the Parts Division to provide it with 10,000 special parts each year. The special parts would require $15.00 per unit in variable production costs.

The Machine Products Division has a bid from an outside supplier for the special parts at $29.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the H56 that it presently is producing. The H56 sells for $32.00 per unit, and requires $19.00 per unit in variable production costs. Packaging and shipping costs of the H56 are $3.00 per unit. Packaging and shipping costs for the new special part would be only $1.00 per unit. The Parts Division is now producing and selling 40,000 units of the H56 each year. Production and sales of the H56 would drop by 20% if the new special part is produced for the Machine Products Division.

Required:

a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 10,000 special parts per year from the Parts Division to the Machine Products Division?

b. Is it in the best interests of Fistman Corporation for this transfer to take place? Explain.

(Note: Due limitations in fonts and word processing software, > and < signs must be used in this solution rather than "greater than or equal to" and "less than or equal to" signs.)

Definitions:

Appendix B

Generally, this term would refer to additional supporting information found at the end of a document, book, or publication, but without a specific context, it is too broad for a unique definition.

Disclosure

The action of making new or secret information known.

AASB 3

An accounting standard detailing the requirements for the accounting of business combinations.

IFRS 3

Business Combinations, an International Financial Reporting Standard that outlines the accounting and reporting requirements for mergers and acquisitions.

Q3: (Ignore income taxes in this problem. )

Q7: The company is considering launching a new

Q9: A properly constructed segmented income statement in

Q14: Division X makes a part that it

Q26: What is the materials quantity variance for

Q29: How much of the $130,000 actual Food

Q63: Ewin Corporation is developing direct labor standards.The

Q90: Knedler Corporation is preparing a bid for

Q122: A project profitability index greater than zero

Q123: The delivery cycle time was:<br>A)10 hours<br>B)2.8 hours<br>C)25.2