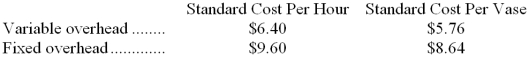

Wriphoff Company uses a standard cost system to collect costs related to the production of its clay bud vases. Manufacturing overhead at Wriphoff is applied to production on the basis of standard direct labor-hours. The overhead standards used at Wriphoff are as follows:  The standards above were based on an expected annual volume of 40,000 bud vases or 36,000 direct labor-hours. The actual results for last year were as follows:

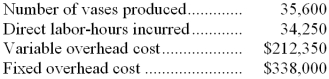

The standards above were based on an expected annual volume of 40,000 bud vases or 36,000 direct labor-hours. The actual results for last year were as follows:

-What was Wriphoff's fixed manufacturing overhead budget variance for last year?

Definitions:

Absorption Costing

A technique in financial accounting that involves accumulating all costs of production, namely direct materials, direct labor, and overhead (both fixed and variable), into the cost base of a product.

Net Operating Income

This is the total profit of a company after operating expenses are subtracted from operating revenues but before income from investments and taxes are considered.

Operating Loss

The loss incurred when a company's operating expenses exceed its revenues, indicating that its core business operations are not profitable.

Year 1

Refers to the first year in a given context, often used in financial projections, company performance analysis, or product lifecycle evaluation.

Q11: The Moore Company produces and sells a

Q20: What is the maximum contribution margin the

Q29: Which of the following costs are always

Q45: Turnhilm,Inc.is considering adding a small electric mower

Q53: The total variable cost at the activity

Q72: The opportunity cost of using one unit

Q82: In a decision to drop a segment,the

Q88: Which of the following variances would be

Q117: In a certain standard costing system the

Q263: Olivier Framing's cost formula for its supplies