Use the following to answer questions

Scenario I

Scenario I is based on fabricated data inspired by the following study:

Curry, N. A. & Kasser, T. (2005) . Can coloring mandalas reduce anxiety? Art Therapy: Journal of American Art Therapy Association, 22(2) 81-85.

Effect of Coloring on Anxiety

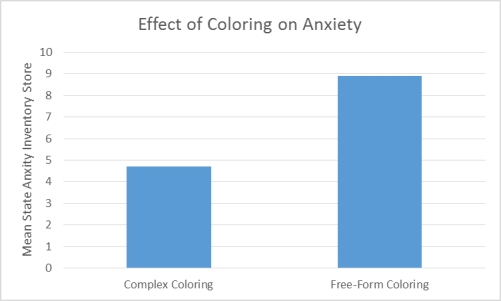

Curry and Kasser were interested in examining whether coloring complex geometric patterns reduces anxiety. To that end, they induced anxiety in 84 undergraduate volunteers from their university. Following anxiety induction the participants were divided into two coloring conditions. To determine which condition each participant would be in the researchers put all of their names in a hat. The first name drawn was placed in group 1, the second name drawn was placed in group 2, the third name drawn was placed in group 1, and so on. Those in the complex geometric coloring condition (group 1) were given a paper with a plaid pattern or the outline of a mandala. Those in the control condition (group 2) were given a blank piece of paper. After 20 minutes of coloring all of the participants completed a self-administered State Anxiety Inventory (SAI) . Lower SAI scores indicate low levels of anxiety whereas higher SAI scores indicate high levels of anxiety. The mean SAI scores of each coloring condition were compared to determine whether the type of coloring one does affects anxiety. The results revealed that those who colored a complex geometric pattern had significantly different levels of anxiety than those who colored on a blank sheet of paper. Curry and Kasser concluded that coloring causes a change in anxiety, but only when coloring requires a certain amount of attention and focus.

Figure 1. Effect of Coloring on Anxiety

-(Scenario I) "Anxiety levels will not differ between those who color complex designs and those color free-form" is an example of a(n) :

Definitions:

Market Demand

The complete sum of a product or service that consumers in a market are willing and can purchase at various price points.

Market Supply

The total quantity of a good or service that sellers are willing and able to sell at various prices within a certain period.

Per-Unit Tax

A tax that is levied on a product based on a fixed amount per unit, affecting the supply curve by elevating production costs.

Tax Burden

The measure of the total amount of taxes imposed by a government on individuals, businesses, and other entities, often expressed as a percentage of GDP.

Q6: Write a brief results section for the

Q7: Dori scored a 52 on an accepted

Q11: Dr.Coria is in the process of reviewing

Q13: What are acceptable ways to randomly assign

Q19: Dr.Okete wants to collect baseline data from

Q20: A t-test for independent means is appropriate

Q33: Dr.Hughes wants to evaluate the test-retest reliability

Q48: A factor other than the intended treatment

Q93: Dr.Malkin described the _ as the sum

Q96: Asking participants to complete two different versions