Lunes Company,a U.S.company,owns a 100% interest in its subsidiary,Placido,S.A. ,located in Italy.Placido,S.A. ,began operations on January 1,2014.The subsidiary's operations consist of leasing space in an office building.The building,which cost one million euros,was financed primarily by Italian banks.All revenues and expenses are received and paid in euros.The subsidiary also maintains its accounting records in euros.In light of these facts,management of the U.S.parent has determined that the euro is the functional currency of the subsidiary.

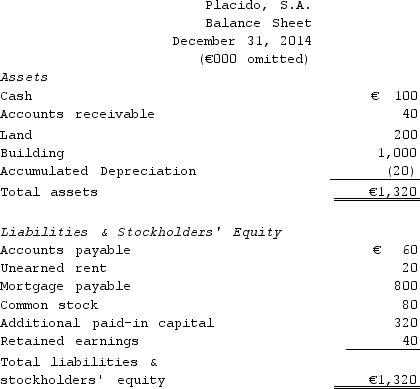

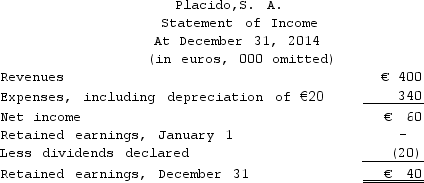

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below,in euros:

The following are relevant exchange rates for the year 2014:

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

Definitions:

Call Option

A financial contract giving the buyer the right, but not the obligation, to purchase an asset at a specified price within a certain time frame.

Strike Price

The predetermined price at which an option's underlying asset can be bought or sold.

Convertible Bond

A type of bond that can be converted into a predetermined number of the issuer's equity shares at certain times during its life, usually at the discretion of the bondholder.

Coupon Rate

The annual coupon divided by the face value of a bond.

Q4: A 0.50-kg object moves on a horizontal

Q7: If,at the end of a period,Michaels Company

Q14: Noser Inc.shows the following data relating to

Q22: What are the three types of period

Q24: Complete the following statement by choosing the

Q40: Asuncion Company purchased some equipment on January

Q45: Under international accounting standards,which of the following

Q63: What is the effect of the sale

Q72: When a company with a complex capital

Q79: In exchange for the rights inherent in