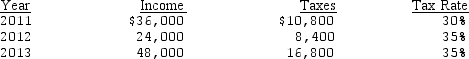

The Morris Corporation reported a $59,000 operating loss in 2014.In the preceding three years,Morris reported the following income before taxes and paid the indicated income taxes:  The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would be

The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would be

Definitions:

Cooperative Hunting

The action of different individuals or species working together to hunt prey, increasing their success rate compared to solo efforts.

Altruism

Behavior of an individual that benefits another at its own cost; in biology, it is often discussed in the context of evolutionary theory and social animals.

Prisoner's Dilemma

A fundamental problem in game theory showing why two individuals might not cooperate, even if it is in both their best interests to do so.

Slave-making Ants

Ant species that invade the colonies of other ants, capturing and forcing the captured ants to work for them.

Q4: Rickles,Inc.is a calendar-year corporation whose financial statements

Q8: On December 31,2014,Behring Enterprises leased equipment from

Q12: Monty Enterprises,a subsidiary of Kerry Company based

Q13: Which of the following principles best describes

Q16: The following segments were identified for an

Q30: Which of the following is correct regarding

Q35: Ignoring income taxes,choose the correct response below

Q38: An entity that reports a discontinued operation

Q40: On January 1,2014,Benjamin Industries leased equipment on

Q56: DeGaulle Enterprises,a subsidiary of Clinton Company based