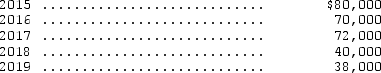

Analysis of the assets and liabilities of Baxter Corp.on December 31,2014,disclosed assets with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the liability basis.The difference in asset basis arose from temporary differences that would reverse in the following years:  The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

Definitions:

Unique Items

Objects or products that are distinct and not identical to any other items, often valued for their exclusivity or rarity.

Small Quantities

Small quantities refer to a less than usual or bulk amount of any material, product, or substance, often required in specific contexts like testing or sample production.

Robo-advisors

Automated platforms that provide financial advice or investment management online with minimal human intervention, using algorithms and software to optimize clients' assets.

Algorithms

Step-by-step procedures or formulas for solving a problem or performing a task.

Q2: Meower Corp.received a charter authorizing 120,000 shares

Q4: Cartel Inc.owns 35 percent of Elliott Corporation.During

Q7: In theory (disregarding any other marketplace variables),the

Q8: The following is Grafton Corporation's comparative balance

Q16: The following segments were identified for an

Q27: Governor Corporation entered into a direct financing

Q32: Omega Company reported net incomes in 2013

Q35: On January 1,2014,Logan Company leased a machine

Q36: Which one of the following items is

Q39: Which of the following is (are)NOT correct