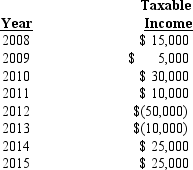

The data shown below represent the complete taxable income history for Confederacy Corporation.The tax rate was 35% throughout the entire period 2008 through 2015:  If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

Definitions:

Psychological Contract

An unwritten agreement of mutual expectations between employees and employers beyond the formal employment contract.

Contributions

Refers to the individual or collective acts of adding or donating something of value to a project, cause, or body of knowledge.

Psychological Contract

The unwritten, implicit expectations and agreements between employees and their employers regarding their mutual obligations.

Inducements

Incentives or rewards offered to employees or other parties to motivate desired behaviors or actions.

Q8: According to FASB ASC Topic 830 (Foreign

Q14: Noser Inc.shows the following data relating to

Q23: Which of the following is characteristic of

Q25: One component of net pension expense,unrecognized gains

Q31: Which of the following,if discovered by Somber

Q31: Information obtained prior to the issuance of

Q37: When a firm changed its method of

Q40: Which of the following tests may be

Q42: The most conceptually appropriate method of valuing

Q65: Pages,Inc.receives subscription payments for annual (one year)subscriptions