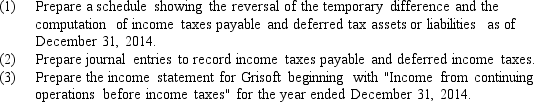

Grisoft Inc.computed a pretax financial income of $40,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $360,000 in unearned rent revenue on the books that had been recognized as taxable income in 2014 when the cash was received.

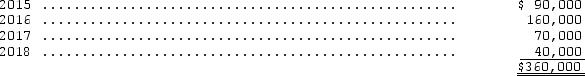

The unearned rent is expected to be recognized on the books in the following pattern:

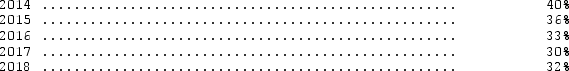

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Definitions:

Clinical Method

A systematic approach used in psychology and medicine that involves observation, assessment, diagnosis, and treatment of patients.

Case Study

A detailed history of an individual that contains data from a variety of sources.

Detailed History

Refers to the thorough collection and examination of past events, circumstances, or background elements, especially in a clinical or research context.

Correlation Method

A statistical technique used to measure and describe the degree and direction of the relationship between two variables.

Q11: For a capital lease,the amount recorded initially

Q15: On January 1,2014,Suppose Company paid property taxes

Q22: During 2013,Rubble Company purchased marketable equity securities

Q25: Indigo Co.was organized on January 2,2014,with the

Q29: In January 2014,Router Mining Corporation purchased a

Q48: Which of the following statements most accurately

Q52: A change from an accelerated depreciation method

Q53: The sum of reportable segment sales must

Q58: Pension-related estimates (not funding data)are provided by

Q74: On January 1,2011,Shine Services Inc.purchased a new