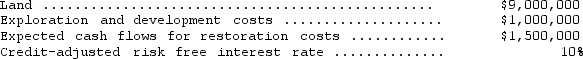

Cavallo Company acquired a tract of land containing an extractable natural resource.Cavallo is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource.Geological surveys estimate that the recoverable reserves will be 2,500,000 tons and that the extraction will be completed in five years.Relevant cost information follows:  What should be the depletion charge per ton of extracted material?

What should be the depletion charge per ton of extracted material?

Definitions:

Net Income

The net income of a business following the subtraction of all costs and tax obligations from its total earnings.

Periodic Inventory System

A method of inventory management in which the inventory levels are updated and cost of goods sold is calculated periodically at the end of a reporting period.

Adjusted Trial Balance

A list of all accounts and their balances after adjusting entries have been made, used to prepare financial statements.

Net Income

The total earnings of a company after subtracting all expenses, taxes, and costs from its total revenue.

Q4: On January 1,Blalock Company as lessee signed

Q18: Which of the following is true regarding

Q23: On January 1,2014,Ashton Company purchased equipment at

Q28: Blue Ice Inc.compensates its employees for certain

Q29: Which of the following temporary differences ordinarily

Q32: Tundra Electronics Company sends appliances to dealers

Q47: Ollie Company entered into a lease agreement

Q53: Stanley Company purchased a machine that was

Q89: Budson Company needs an estimate of its

Q97: Knitness Menswear,Inc.maintains a markup of 60 percent