Depreciation is the systematic allocation of historical depreciable cost to periods in which an asset is used.Depreciation is not a cash outflow but does reduce reported income and thus retained earnings by the depreciable cost of the asset less the tax savings associated with depreciation.

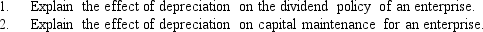

Required:

Definitions:

Decreasing Costs

A situation where the expenses of producing a good or service fall over time, typically due to efficiency improvements or economies of scale.

LIFO Method

An inventory valuation method called "Last In, First Out," where the cost of the most recently purchased items is the first to be expensed as cost of goods sold.

Net Income

Refers to the total earnings or profit of a company after subtracting all expenses and costs from its total revenue.

FIFO Method

"First In, First Out," an inventory valuation method where goods first purchased or produced are the first to be sold, affecting cost of goods sold and inventory value.

Q4: On August 1,a firm assigned $30,000 of

Q7: Feinberg,Inc. ,provides a noncontributory defined benefit plan

Q10: A copyright is an example of which

Q17: Which of the following research and development

Q34: Which of the following is not correct

Q47: Ollie Company entered into a lease agreement

Q63: A company using the group depreciation method

Q66: An eight-year capital lease specifies equal minimum

Q67: Stock warrants outstanding should be classified as<br>A)

Q101: Which one of the following would cause