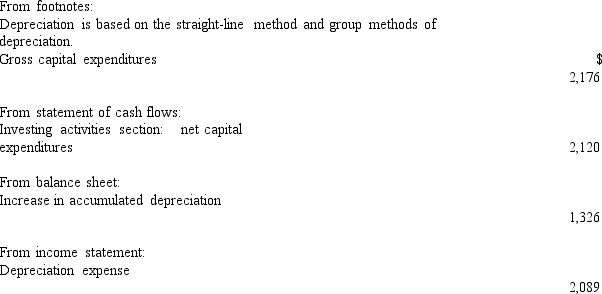

The most recent annual report of the Albondiga Company includes the following information:

(in millions of dollars)

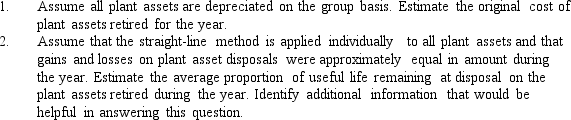

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

Required:

Definitions:

Hourly Price

The cost associated with purchasing a good or service for each hour it is used or consumed.

Production Technology

The methods, equipment, and processes used to produce goods and services.

Economic Profit

The split between total financial receipts and overall disbursements, considering both direct and hidden expenses.

Accounting Profit

The net income a company generates calculated by subtracting total explicit costs from total revenues, according to generally accepted accounting principles (GAAP).

Q15: Soundesign Company entered into a lease of

Q32: Supplemental disclosures required only when the statement

Q39: Backhoe Construction Company recently exchanged an old

Q55: Analysis of the assets and liabilities of

Q56: Depreciation of noncurrent operating assets is an

Q62: Athletes Sporting Goods began operations February 1,2014.Athletes

Q67: Which of the following factors are used

Q70: Silken Corp.reported net income of $420,000 for

Q76: Daniels Company entered into a direct-financing lease

Q79: According to the most current FASB standards,intangible