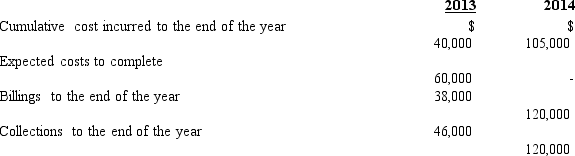

Johann Builders has a fixed -price contract providing $120,000 of revenue.Construction on the contract was begun in 2013 and was completed in 2014.Information relating to the contract is as follows:  What amount of income should Johann recognize in 2014 assuming that the company appropriately uses the percentage-of-completion method of income recognition?

What amount of income should Johann recognize in 2014 assuming that the company appropriately uses the percentage-of-completion method of income recognition?

Definitions:

Petty Cash Account

A small amount of cash kept on hand for minor or incidental expenses, managed through a specified fund.

Purpose

The reason for which something is done or created or for which something exists.

General Journal Entry

A general journal entry is a record of financial transactions that includes details such as date, accounts impacted, amounts, and a brief description of the transaction.

Petty Cash Fund

A petty cash fund is a small amount of cash on hand used for paying expenses too small to merit writing a check or using a credit card.

Q11: Based on the aging of its accounts

Q11: Which of the following principles best describes

Q38: See Teeming Company information above.If Teeming determines

Q43: See information regarding Dingo Boot Company above.The

Q47: Failure to record depreciation expense at the

Q54: Which of the following events would be

Q63: The normal order followed by the FASB

Q73: In contrast with a multiple-step income statement,a

Q77: A wholesale bakery would normally recognize revenue

Q80: The following is a summary of the