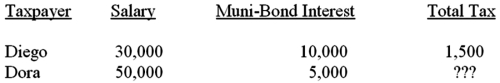

Given the following tax structure,what is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to effective tax rates?

Definitions:

International Sale of Goods

Transactions involving the purchase and sale of goods across national borders, governed by specific laws and agreements to facilitate and regulate trade.

Boycotts

Organized refusal to buy, use, or participate in something as a form of protest or a means of coercion.

Quotas

Preset limits or targets on the quantity of specific goods that can be imported or exported within a certain time frame to regulate trade.

World Bank

A nongovernmental organization that works exclusively with the poorest nations in the international community to help them secure loans.

Q2: Congress can only pass legislation that falls

Q19: Defamation involves wrongfully hurting a person's good

Q20: Kathy is 48 years of age and

Q20: §1239 recharacterizes 50 percent of the gain

Q29: Ethics is concerned with the fairness or

Q35: Refer to Fact Pattern 3-A3.If Liz decides

Q37: Given the following tax structure,what is the

Q38: Refer to Fact Pattern 3-A3.If either party

Q63: Brad sold a rental house that he

Q90: Jacob participates in his employer's defined benefit