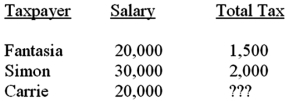

Given the following tax structure,what amount of tax would need to be assessed on Carrie to make the tax horizontally equitable? What is the minimum tax that Simon should pay to make the tax structure vertically equitable based on Fantasia's tax rate? This would result in what type of tax rate structure?

Definitions:

Price-Support Program

Government interventions designed to maintain the market price of a good at a certain level.

Particular Crop

A specific type of crop grown for agricultural production, often defined by its use or species.

Price Ceiling

A legally imposed limit on the price charged for a product, intended to prevent prices from reaching levels deemed too high.

Price Support Program

Government initiatives intended to maintain the market price of a good or service above its equilibrium level by buying excess supply or restricting supply.

Q9: A net §1231 gain becomes ordinary while

Q11: Fealty Credit Corporation asks its employees to

Q18: The minimal acceptable standard for ethical behavior

Q42: Which one of the following is not

Q43: Kevin bought 200 shares of Intel stock

Q48: Which of the following is false regarding

Q53: Cory recently sold his qualified small business

Q69: Employers often withhold federal income taxes directly

Q81: Geronimo files his tax return as a

Q104: Given the following tax structure,what amount of