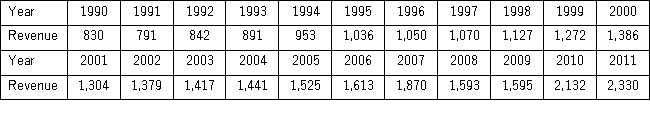

The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

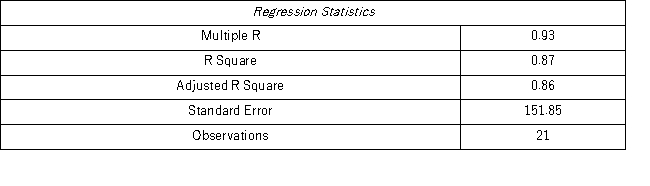

Model AR(1):

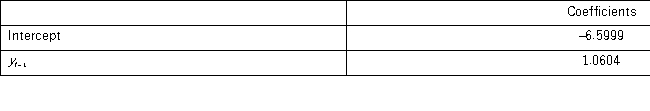

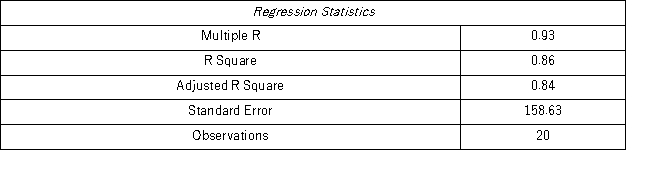

Model AR(2):

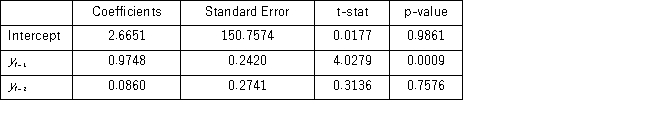

Model AR(2):

Compare Excel outputs for AR(1)and AR(2)and choose the forecasting model that seems to be better.

Compare Excel outputs for AR(1)and AR(2)and choose the forecasting model that seems to be better.

Definitions:

Par

A value assigned the shares of capital stock and stated on the stock certificate.

Dividend

A portion of a company's earnings distributed to its shareholders, typically in cash or additional shares.

Dividend Per Share

The sum of money paid by a company to its shareholders, divided by the total number of shares outstanding, usually expressed as a dollar amount per share.

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock, usually with no voting rights but with a fixed dividend.

Q1: A polynomial trend model that only allows

Q16: A researcher wants to examine how the

Q19: A company that produces financial accounting software

Q19: Price indices are used to remove the

Q25: In a moving average method,when a new

Q41: Which of the following statements is true

Q48: The optimal value of the speed of

Q78: Which of the following is a criticism

Q95: The two broad fields that make up

Q129: Suppose that a worker in Country A