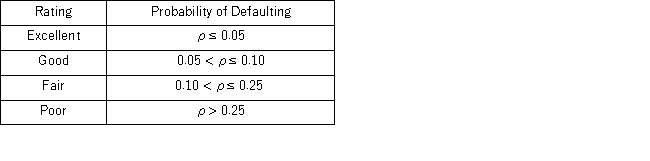

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank.The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability,she decided to use the logistic model

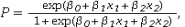

To estimate this probability,she decided to use the logistic model  where

where

y = a binary response variable with value of 1 corresponding to a default,and 0 to a no default

x1 = the ratio of the credit card balance to the credit card limit (in %)

x2 = the ratio of the total debt to the annual income (in %)

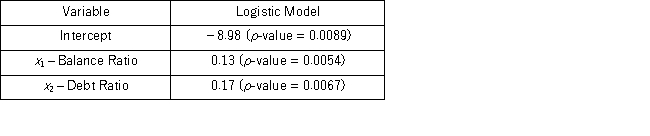

Using Minitab on the sample data,she arrived at the following estimates:  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

If only applicants with excellent and good ratings are qualified for a loan,find a linear relation between their balance ratio and their debt ratio that must be satisfied to be qualified.

Definitions:

Emotional Intelligence

Ability to recognize, understand, manage, and utilize one's own emotions and the emotions of others effectively in interpersonal relationships.

Required Emotions

Emotions that individuals are expected to display in certain situations or roles, often dictated by social or professional norms.

True Emotions

Authentic feelings that reflect an individual's genuine emotional state, without pretense or suppression.

Emotional Intelligence

The ability to recognize, understand, manage, and reason with emotions in oneself and others, which is critical for effective communication, leadership, and relationships.

Q15: Consider the following data on the prices

Q29: The quadratic and logarithmic models,y = β<sub>0</sub>

Q55: Over the past 30 years,the sample standard

Q70: A bank manager is interested in assigning

Q73: Given the following portion of regression results,which

Q73: Typically,the sales volume declines with an increase

Q76: If the null hypothesis is rejected by

Q76: The correlation coefficient can only range between

Q104: The number of dummy variables representing a

Q120: Consider the sample regression equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg"