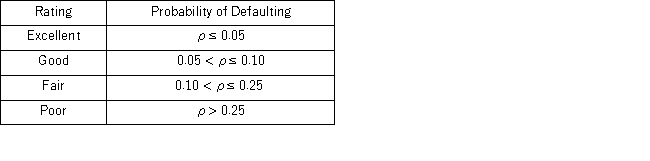

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank.The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability,she decided to use the logistic model

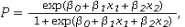

To estimate this probability,she decided to use the logistic model  where

where

y = a binary response variable with value of 1 corresponding to a default,and 0 to a no default

x1 = the ratio of the credit card balance to the credit card limit (in %)

x2 = the ratio of the total debt to the annual income (in %)

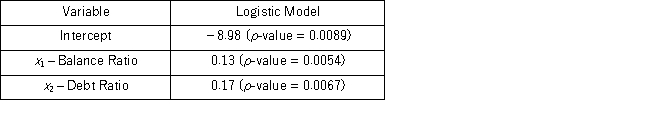

Using Minitab on the sample data,she arrived at the following estimates:  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Bob has a balance ratio of 10%,an annual income of $80,000,and $15,000 in total debt.Only applicants with excellent and good ratings qualify for a loan.Find the maximum amount of loan Bob can get if he is required to maintain his excellent or good rating after getting this amount.

Definitions:

Product Advantages

The unique benefits or value a product offers to a customer, distinguishing it from competitor offerings.

SELL Sequence

SELL sequence is a sales strategy that outlines a sequence of steps Salespersons follow to effectively sell a product or service, usually involving stages like Show, Explain, Lead, and Lock.

Sales Presentation

A pitch or demonstration given by a salesperson to persuade potential buyers to purchase a product or service.

FAB Selling Technique

A presentation technique stressing features, advantages, and benefits of a product.

Q9: If the data are available on the

Q20: To avoid the dummy variable _,the number

Q41: Which of the following statements is true

Q49: The following table includes the information about

Q63: Consider the following simple linear regression model:

Q63: Investment institutions usually have funds with different

Q101: .The following table shows the number of

Q104: In the following table,likely voters' preferences of

Q106: In which of the following situations is

Q106: A researcher analyzes the factors that may