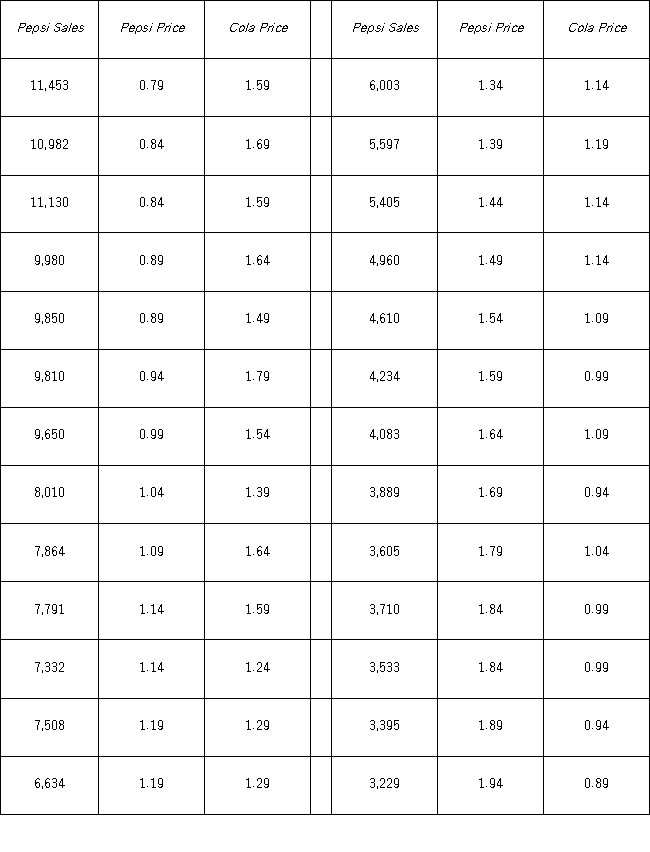

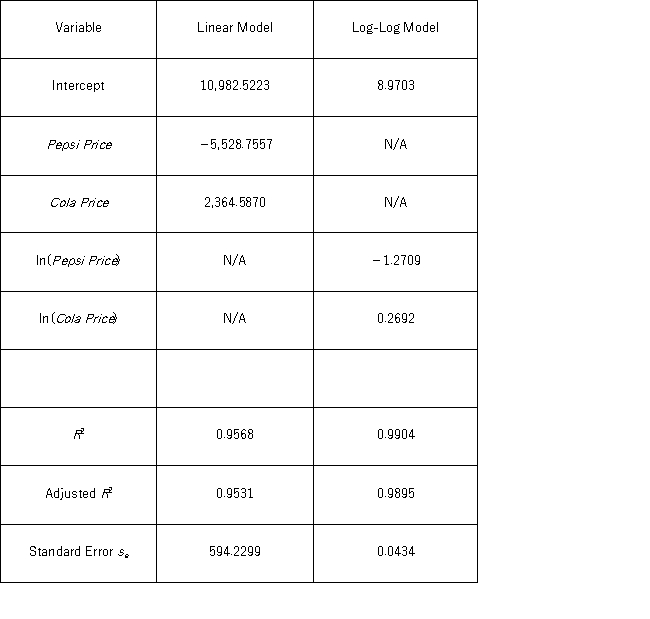

It is believed that the sales volume of one-liter Pepsi bottles depends on the price of the bottle and the price of a one-liter bottle of Coca-Cola.The following data have been collected for a certain sales region.  Using Excel's regression,the linear model Pepsi Sales = β0 + β1Pepsi Price + β2Cola Price + ε and the log-log model ln(Pepsi Sales)= β0 + β1ln(Pepsi Price)+ β2ln(Cola Price)+ ε have been estimated as follows:

Using Excel's regression,the linear model Pepsi Sales = β0 + β1Pepsi Price + β2Cola Price + ε and the log-log model ln(Pepsi Sales)= β0 + β1ln(Pepsi Price)+ β2ln(Cola Price)+ ε have been estimated as follows:  What is the estimated linear regression model?

What is the estimated linear regression model?

Definitions:

Net Sales

Revenue from sales reduced by customer discounts, returns, and allowances.

Held-to-Maturity Debt Securities

Financial instruments that a firm intends and is able to hold until they mature, usually recorded at cost adjusted for amortization.

Equity Securities

Financial instruments that represent ownership interest in a company, such as stocks, granting holders a claim on part of the company's assets and earnings.

Insignificant Influence

Refers to a situation where an investor cannot exert significant control or influence over the investee company.

Q9: If the data are available on the

Q25: An energy analyst wants to test if

Q42: The heights (in cm)for a random sample

Q47: If a sample of size n is

Q59: The accompanying table shows the regression results

Q61: The heights (in cm)for a random sample

Q88: The accompanying table shows the regression results

Q93: The following scatterplot indicates that the relationship

Q101: A card-dealing machine deals spades (1),hearts (2),clubs

Q105: A marketing analyst wants to examine the