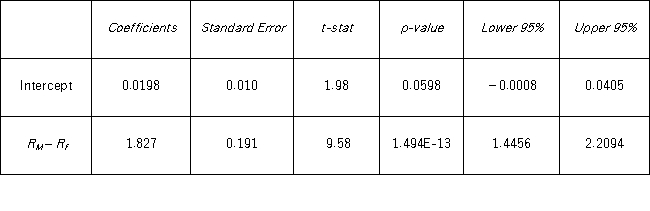

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

Definitions:

Liabilities

Financial obligations or debts owed by a company to external parties, creditors, or suppliers that must be settled over time.

Shareholders' Equity

The residual interest in the assets of a company after subtracting liabilities, representing ownership equity.

Total Assets

The sum of all current and noncurrent assets owned by a company, reflecting its overall value.

Retained Earnings

The portion of a company's net income that is held or retained for reinvestment in the business or to pay debt, rather than being paid out as dividends.

Q2: A manager at a local bank analyzed

Q7: The value of the test statistic for

Q24: In the estimation of a multiple regression

Q25: AutoTrader.com would like to test if a

Q39: Consider the following sample regression equation <img

Q40: When estimating a multiple regression model based

Q67: A sports analyst wants to exam the

Q71: A professor applies the variance in scores

Q114: The heights (in cm)for a random sample

Q122: A marketing analyst wants to examine the