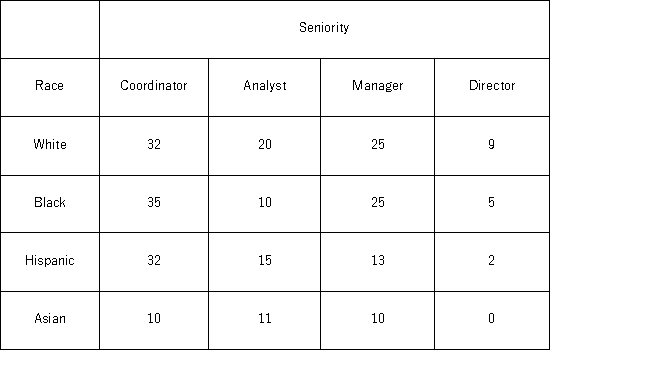

The following table shows the distribution of employees in an organization.Martha Foreman,an analyst,wants to see if race has a bearing on the position a person holds with this company.  The column total for directors is _____.

The column total for directors is _____.

Definitions:

Content Validity

A measure of whether a test or tool covers a comprehensive range of relevant aspects of the subject it aims to assess.

Work Samples

Pieces of work or projects used to demonstrate an individual's skills, abilities, and experience in a particular area or profession.

Cognitive Ability Test

An assessment designed to measure a person’s mental capacity, including memory, reasoning, and problem-solving skills.

Numerical Ability

The capability to perform mathematical calculations and understand numerical data, often assessed in educational and employment contexts.

Q5: Construct a 95% confidence interval for the

Q11: A tutor promises to improve GMAT scores

Q19: Consider the following regression results based on

Q61: The test statistic for testing the difference

Q75: Tiffany & Co.has been the world's premier

Q96: The null hypothesis typically corresponds to a

Q96: The sample correlation coefficient cannot equal zero.

Q98: You want to test if more than

Q103: With the partial F test,we basically analyze

Q116: The hypothesis statement H: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="The