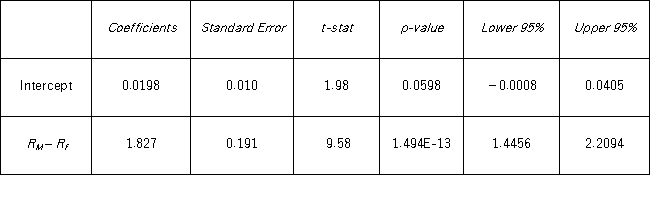

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the capital asset pricing model (CAPM) model for Tiffany's return.  You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses: __________________.

You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses: __________________.

Definitions:

Freedom of Choice

The ability or right to make one's own decisions without coercion or constraint.

Stage of Life

Specific phases that an individual passes through during their lifetime, marked by distinct physical, psychological, or social characteristics.

Choice Corollary

A principle in George Kelly's personal construct theory, suggesting that individuals choose their processes among those available to them based on anticipated events.

Repeated Events

Occurrences or happenings that take place more than once, often following a similar pattern each time.

Q10: A financial analyst examines the performance of

Q12: Given the following portion of regression results,which

Q17: Thirty employed single individuals were randomly selected

Q51: Quarterly sales of a department store for

Q64: The statistical inference concerning the difference between

Q70: The confidence interval for the difference <img

Q73: You want to test whether the population

Q86: Which of the following correctly identifies the

Q102: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Consider

Q118: Consider the following regression results based on