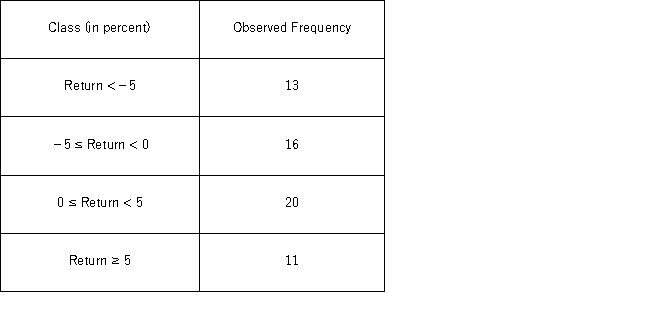

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.At the 5% confidence level,which of the following is the correct conclusion for this goodness-of-fit test for normality?

Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.At the 5% confidence level,which of the following is the correct conclusion for this goodness-of-fit test for normality?

Definitions:

Control Account

An account used to summarize transactions recorded in subsidiary ledgers for a comprehensive total in the general ledger.

Predetermined Overhead Rate

A calculated rate used to estimate the manufacturing overhead cost per unit of production, based on expected costs and activity levels.

Manufacturing Overhead

Indirect factory-related costs that occur from manufacturing a product such as the cost of managing a factory.

Accumulated Depreciation

The total amount of depreciation expense that has been charged against a fixed asset since it was put into use.

Q11: The scatterplot shown below represents a typical

Q29: The quadratic and logarithmic models,y = β<sub>0</sub>

Q48: AutoTrader.com would like to test if a

Q62: A university interested in tracking its honors

Q63: The student senate at a local university

Q78: Calculate the value of R<sup>2 </sup>given the

Q89: The calculation of the Jarque-Bera test statistic

Q97: Students are planning a bake sale to

Q101: Consider the following simple linear regression model:

Q103: With the partial F test,we basically analyze