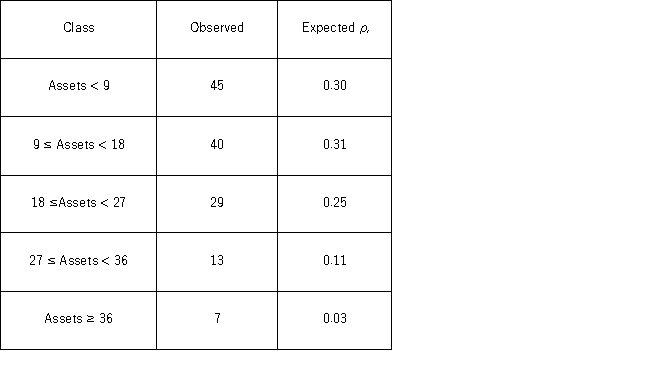

The following table shows the observed frequencies of the amount of assets under management for a sample of 134 hedge funds.The table also contains the hypothesized proportion of each class assuming the amount of assets under management has a normal distribution.The sample mean and standard deviation are 15 billion and 11 billion respectively.  a.Set up the competing hypotheses for the goodness-of-fit test of normality for amount of assets under management.

a.Set up the competing hypotheses for the goodness-of-fit test of normality for amount of assets under management.

b.Calculate the value of the test statistic and determine the degrees of freedom.

c.Specify the critical value at the 5% significance level.

d.Is there evidence to suggest the amount of assets under management do not have a normal distribution?

e.Are there any conditions that may not be satisfied?

Definitions:

Predetermined Overhead Rate

A rate calculated at the beginning of a period by dividing estimated total overhead costs by an estimated allocation base, used to apply overhead to products or services.

Automated Bandsaw

A type of bandsaw equipped with automatic features for cutting, which can enhance precision and efficiency in manufacturing processes.

Unused Capacity

The difference between a company's actual production and its maximum possible production without additional capital investment.

Job-Order Costing

An accounting method that tracks the costs associated with creating a specific product or delivering a specific service, making it possible to calculate the profit on individual jobs.

Q31: The accompanying table shows the regression results

Q35: A medical devices company wants to know

Q45: A sociologist examines the relationship between the

Q50: Which of the following is a correct

Q53: A university is interested in promoting graduates

Q60: A financial analyst examines the performance of

Q75: Suppose Bank of America would like to

Q92: Placing the larger sample variance in the

Q97: In a simple linear regression model,if the

Q117: An engineer is designing an experiment to