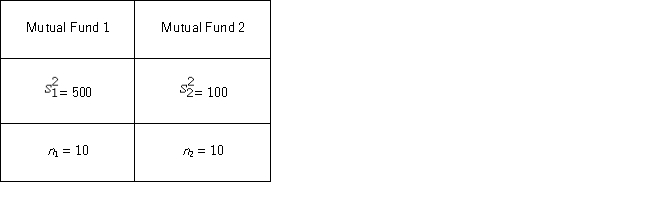

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  For the competing hypotheses

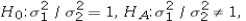

For the competing hypotheses  which of the following is the correct approximation of the p-value?

which of the following is the correct approximation of the p-value?

Definitions:

Fixed Costs

Expenses that do not change with the level of output or sales, such as rent, salaries, and insurance.

Diseconomies of Scale

The phenomenon where production cost per unit increases as the scale of output increases, usually due to factors like increased complexity and inefficiencies.

Long-run Average Total Cost

The per unit cost of production when all inputs, including capital, are variable, typically depicting economies and diseconomies of scale.

Marginal Cost

The additional cost resulting from the creation of one more unit of a product or service.

Q6: In the estimation of a multiple regression

Q10: An marketing analyst wants to examine the

Q26: A university has six colleges and takes

Q69: Many cities around the United States are

Q77: The following frequency distribution shows the monthly

Q84: A newly hired basketball coach promised a

Q84: In the following table,likely voters' preferences of

Q88: For a given confidence level and sample

Q108: The ages of MBA students at a

Q120: A researcher analyzes the factors that may