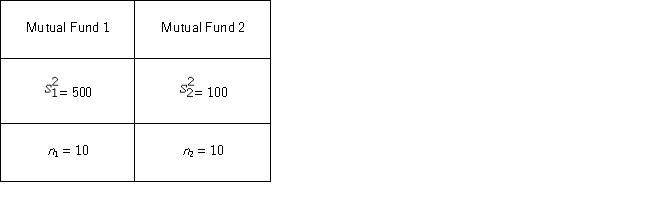

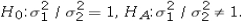

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  Which of the following is the critical F value at the 10% significance level?

Which of the following is the critical F value at the 10% significance level?

Definitions:

Long-Term Borrowing

Debt obtained by a company for a period exceeding one year, typically used for financing more substantial investments or projects.

Q14: For the goodness-of-fit test,the chi-square test statistic

Q29: A restaurant chain has two locations in

Q47: A bicycle manufacturer makes downhill mountain bikes

Q47: If a sample of size n is

Q74: In the following table,individuals are cross-classified by

Q90: The following frequency distribution shows the monthly

Q106: For a statistical inference regarding <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg"

Q115: A sample of 2,007 American adults was

Q121: The accompanying table shows the regression results

Q126: The critical value approach specifies a range