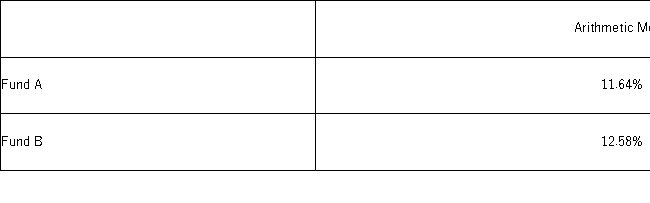

The following table summarizes selected statistics for two portfolios for a 10-year period ending in 2006.Assume that the risk-free rate is 4% over this period.  As measured by the Sharpe ratio,the fund with the superior risk-adjusted performance during this period is _________________________________________________________.

As measured by the Sharpe ratio,the fund with the superior risk-adjusted performance during this period is _________________________________________________________.

Definitions:

Government Interference

Actions taken by government to affect decisions made by individuals, companies, or other governments, which can include regulations, laws, and taxes.

Market Equilibrium

A situation where, at the current price, the quantity of goods supplied equals the quantity of goods demanded, leading to a stable market condition.

Optimal Allocation

The most efficient distribution of resources and services, maximizing the benefit from their use.

External Costs

Costs not reflected in the market price of goods or services, borne by a third party or society at large.

Q6: Think about your recent group projects. Identify

Q8: Conrad and Celeste have been dating for

Q17: Events are exhaustive if they do not

Q18: Two stocks,A and B,have a historical correlation

Q23: Which of the following is the most

Q33: A continuous random variable X assumes an

Q44: Suppose the wait to passthrough immigration at

Q46: The following data represent the wait time,in

Q93: Given two random variables X and Y,the

Q102: Suppose residents in a well-to-do neighborhood pay