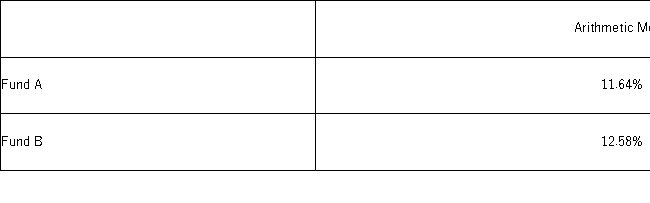

The following table summarizes selected statistics for two portfolios for a 10-year period ending in 2006.Assume that the risk-free rate is 4% over this period.  As measured by the Sharpe ratio,the fund with the superior risk-adjusted performance during this period is _________________________________________________________.

As measured by the Sharpe ratio,the fund with the superior risk-adjusted performance during this period is _________________________________________________________.

Definitions:

Openness To Feedback

The willingness or ability to receive and consider information or opinions from others, typically aimed at personal growth or improvement.

Case Conceptualization/formulation

involves the therapist's process of gathering and organizing information about a client to understand their issues and guide the treatment strategy.

Determination Of Client Goals

The process of identifying and setting specific, measurable objectives for a client in a professional setting.

Assessing For Client Strengths

The process of identifying and focusing on the skills, interests, and capabilities of a client, which can be used as a foundation for therapy or counseling.

Q1: The following data are a list of

Q5: The stock price of a particular asset

Q16: The table below gives the deviations of

Q20: The likelihood of Company A's stock price

Q32: A small company that manufactures juggling equipment

Q49: Which of the following scales represents the

Q54: Sam is a trucker and believes that

Q83: The average class size this semester in

Q91: Students in Professor Smith's business statistics course

Q105: The z-score has no units even though