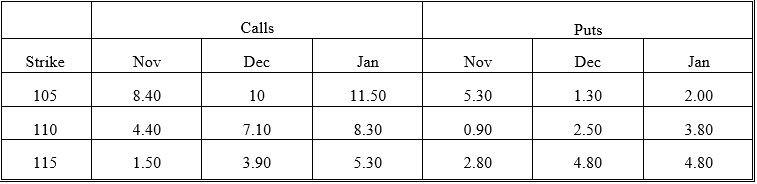

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the November 105 put?

Definitions:

Parallel Lines

Lines in a plane that never meet, no matter how far they are extended.

Unified Object

A concept or entity perceived as a whole, where all components are considered together rather than individually.

Perceiving Distance

The cognitive process of determining the distance from oneself to an object or place, often involving visual and auditory cues.

Retinal Disparity

The slight difference in images processed by each eye, which contributes to depth perception and the ability to see the world in three dimensions.

Q2: Based on the price sensitivity hedge ratio,if

Q4: Enterprise risk management includes all of the

Q13: The binomial model assumes that investors are

Q13: Which of the following is equivalent to

Q15: If the stock index is at 148,the

Q19: Companies can benefit from risk management if

Q40: _ are all goods and services sold

Q47: A lookback call option provides the right<br>A)to

Q49: The value of a pay-fixed,receive floating interest

Q53: A quanto is a derivative involving two