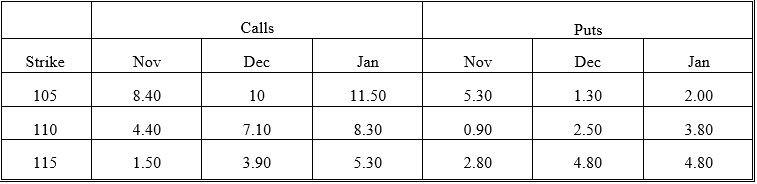

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the November 105 put?

Definitions:

Call Provision

Agreement giving the corporation the option to repurchase the bond at a specified price before maturity.

Bond Indenture

A legal contract detailing the terms and conditions under which bonds are issued, including the interest rate, maturity date, and other conditions.

Time Premium

The portion of an option's price that exceeds its intrinsic value, reflecting the value of time left until expiration.

Exercise Price

The price at which an option holder can buy or sell the underlying security.

Q2: The Black-Scholes-Merton formula can be used in

Q16: Futures contracts are similar to forward contracts

Q16: An interest rate swap with both sides

Q18: The dollar value of a one basis

Q26: Which of the following statements about the

Q30: When futures accounts are marked-to-market,an account balance

Q34: What is the theoretical value of the

Q40: If we now assume that the stock

Q54: The option's delta is approximately the change

Q121: Which of the following arguments against globalization