Probabilities and relative frequencies are related in that the probability of an outcome is the proportion of the time that the outcome occurs in the long run.Hence concepts of joint,marginal,and conditional probability distributions stem from related concepts of frequency distributions.

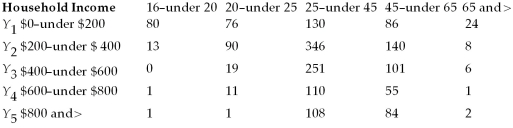

You are interested in investigating the relationship between the age of heads of households and weekly earnings of households.The accompanying data gives the number of occurrences grouped by age and income.You collect data from 1,744 individuals and think of these individuals as a population that you want to describe,rather than a sample from which you want to infer behavior of a larger population.After sorting the data,you generate the accompanying table:

Joint Absolute Frequencies of Age and Income,1,744 Households

Age of head of household

X1 X2 X3 X4 X5  The median of the income group of $800 and above is $1,050.

The median of the income group of $800 and above is $1,050.

(a)Calculate the joint relative frequencies and the marginal relative frequencies.Interpret one of each of these.Sketch the cumulative income distribution.

(b)Calculate the conditional relative income frequencies for the two age categories 16-under 20,and 45-under 65.Calculate the mean household income for both age categories.

(c)If household income and age of head of household were independently distributed,what would you expect these two conditional relative income distributions to look like? Are they similar here?

(d)Your textbook has given you a primary definition of independence that does not involve conditional relative frequency distributions.What is that definition? Do you think that age and income are independent here,using this definition?

Definitions:

Degrees Of Freedom

The count of the number of values in a calculation that are free to vary without infringing on the given data.

T-Distribution

A probability distribution that arises in the sampling distribution of sample means, especially useful when the sample size is small and the population standard deviation is unknown.

Normal Distribution

A bell-shaped curve where a large number of data points are symmetrically distributed around the mean, with fewer and fewer observations the further away from the mean.

Point Estimate

A single value or statistic that serves as the best guess or most reasonable approximation of a population parameter.

Q3: In the case of perfect multicollinearity,OLS is

Q10: Your textbook uses the following example of

Q12: To study the determinants of growth between

Q13: Your textbook modifies the four assumptions for

Q18: Panel data estimation can sometimes be used<br>A)to

Q30: A multiperiod regression forecast h periods into

Q32: The Granger Causality Test<br>A)uses the F-statistic to

Q42: The difference between the central limit theorems

Q55: The expected value of a discrete random

Q65: A few years ago the news magazine